Retirement is much different than when you are in the accumulation stage of your life. For instance, while you are accumulating assets, you have the time horizon to wait out a bear market. As a pre-retiree or retiree, you do not. As we found out in 2008, bear markets can wipe out retirement savings for people who need to withdraw money to live on each month. As you get closer to retirement, you need wealth management that takes advantage of markets, but also protects your assets against market downturns. Advance retirement planning is the only way you can take control of your future retirement prospects.

RETIREMENT PLANNING

RETIREMENT PLANNING

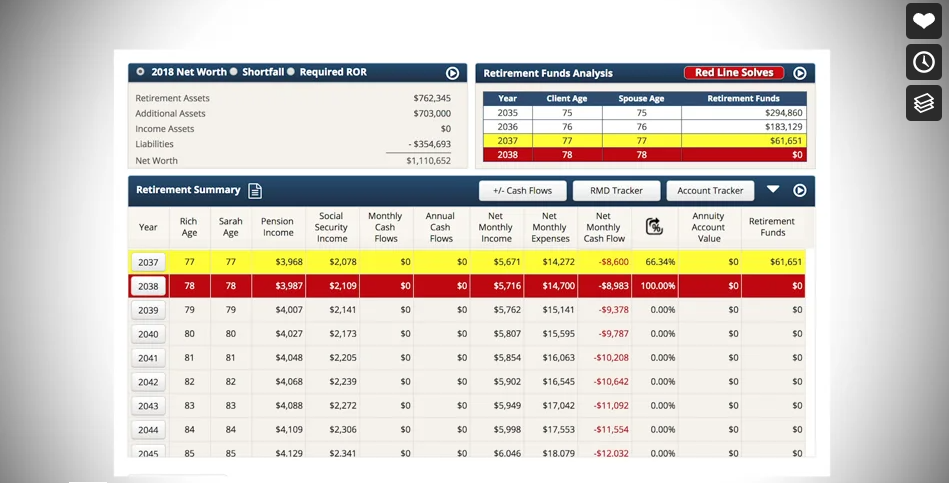

Retirement plans help you determine realistic retirement income needs, assess income and lifestyle goals and assemble, recommend and implement various tactics to achieve them. A retirement plan identifies sources of income, estimates expenses, spells out year-by-year draw-downs, estimates cash flow and much more. Whether you are decades away from retirement, or almost there, a solid retirement plan takes you from the place of earning money every month, to spending the money you have accumulated in the most efficient way—a way that will last throughout your retirement no matter how long you live.

REQUIRED MINIMUM DISTRIBUTIONS

Do you realize that starting at age 72, you are required to start withdrawing money from your pre-tax qualified plans like 401(k)s and traditional IRAs? With any qualified, tax-deferred retirement account or investment, you are required to withdraw a certain percentage from each account, with few exceptions, and the money must be withdrawn on or before December 31st of the year it is due. The penalty if you don’t do your RMDs on time or withdraw from the proper accounts? Fifty percent of what you should have withdrawn, plus the income tax due on that amount if applicable! When it comes to RMDs, our goal is to help you develop a withdrawal strategy which minimizes your taxes so you can keep as much of your life savings as possible for you and/or your heirs.

RMDs are a very big deal. Many retirees don’t realize that they may be thrown into a higher tax bracket as a result of the mandatory withdrawals, and they’re upset that they have to take money out that they might not even need. At URA Group AZ, we create a customized, master retirement roadmap for each of our clients detailing RMDs as part of their distribution plan. It is very important to liquidate your accounts in the order that will minimize your taxes due. We will calculate your projected income taxes and determine if converting some money to Roth IRAs might be to your financial benefit over a period of time. In fact, we analyze and assess many different strategies to help save you money in retirement.

REQUIRED MINIMUM DISTRIBUTIONS

Do you realize that starting at age 72, you are required to start withdrawing money from your pre-tax qualified plans like 401(k)s and traditional IRAs? With any qualified, tax-deferred retirement account or investment, you are required to withdraw a certain percentage from each account, with few exceptions, and the money must be withdrawn on or before December 31st of the year it is due. The penalty if you don’t do your RMDs on time or withdraw from the proper accounts? Fifty percent of what you should have withdrawn, plus the income tax due on that amount if applicable! When it comes to RMDs, our goal is to help you develop a withdrawal strategy which minimizes your taxes so you can keep as much of your life savings as possible for you and/or your heirs.

RMDs are a very big deal. Many retirees don’t realize that they may be thrown into a higher tax bracket as a result of the mandatory withdrawals, and they’re upset that they have to take money out that they might not even need. At URA Group AZ, we create a customized, master retirement roadmap for each of our clients detailing RMDs as part of their distribution plan. It is very important to liquidate your accounts in the order that will minimize your taxes due. We will calculate your projected income taxes and determine if converting some money to Roth IRAs might be to your financial benefit over a period of time. In fact, we analyze and assess many different strategies to help save you money in retirement.

THE RETIREMENT ENGINEERING PROCESS

The CORE Process is a proprietary retirement planning process developed by the founder of URA Group AZ. The CORE retirement planning system uses the latest technologies, information, products and approaches to design complete, bold, flexible and stress-free retirements. Planning ahead for what you will face in retirement is critical to your success, and helping ensure that you never run out of money no matter how long you live.

Just one of the many software packages we’ve invested in to help our clients is called Retirement Analyzer. At URA Group AZ, we don’t know how anyone can be sure about their retirement without running this program (and many others) against your actual portfolio and your actual parameters.

RECEIVE YOUR PERSONALIZED RETIREMENT PLANNING BLUEPRINT

Your blueprint coordinates all your retirement assets—including Social Security and pensions—with special attention to the effect that taxation will have on the future overall picture of your retirement. Using the latest state-of-the-art software, every URA Group AZ retirement planning roadmap contains a detailed forecast of exactly how your retirement will be funded on a yearly basis based on your assets. The retirement planning roadmap will also include a side-by-side comparison between a current plan, a current retirement plan in a rising tax rate environment, and how a plan will perform once the necessary steps are taken to provide yourself with the optimal amount of wealth.

SET UP A COMPLIMENTARY APPOINTMENT

We promise to deliver you value when you meet with us face-to-face or virtually online. Even if we mutually determine we are not a good fit, we pledge to deliver you at least one actionable piece of information that will help you.Additionally, we will gift you a copy of the book,Win By Not Losing. It’s definitely a win!

Call 480.448.6270 or fill out this form.

*FREE BOOK INCLUDED