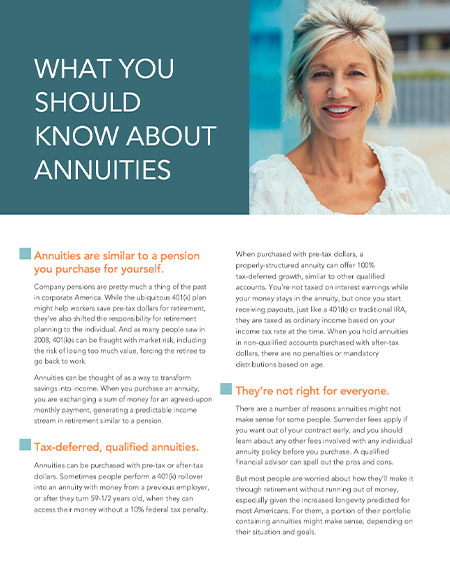

At URA Group AZ, one area we focus on with our clients is keeping their nest egg as safe as possible, while still participating in market growth. Many retirees underestimate the impact that a big market loss can have on the future of their income. When you’re forced to withdraw money when the market is down, you’re taking out a larger percentage, which will affect you negatively for years down the road—like compounding interest in reverse. Through the use of annuities and life insurance, you can create steady, dependable monthly income.

FIXED PRINCIPAL

FIXED PRINCIPAL IN RETIREMENT

The “safe” bonds touted by some financial professionals—usually brokers or dually-licensed financial advisors who are not true fiduciaries—are returning record lows and the Fed plans to keep interest rates low for the near future. If interest rates do rise, bond values drop! We have found alternatives to bonds that many economic experts say can perform better—specifically, fixed indexed annuities. These policies can protect your initial investment principal while allowing growth with protection from market downturns, accruing interest based on stock market gains even though the policies are not directly invested in the stock market.